Higher education is one of the wisest investments someone can make in their future—but the rising cost of college can make a degree seem out of reach. Independent lenders have an incredible opportunity to help people fully realize their academic and professional potential.

At-a-Glance: Where Do Private Student Loans Come In?

Most colleges and universities that offer traditional undergraduate and graduate degree programs participate in financial aid programs that help students offset the cost of their education, most notably government-backed loans and the federal Pell Grant, both from the U.S. Department of Education (DOE). Students may also qualify for state- or institution-funded grants and or be eligible for a merit scholarship. Still, there’s often a gap—sometimes a significant one—between the financial aid offered and the total cost of attendance for that academic year. We call this unmet aid, and this is where low-interest, education-friendly alternative loans come in.

So private student loans can bridge the gap between sticker price and financial aid offered, but they also provide a solution for other unique borrowing needs:

- Law school and medical school: By the time students enter these multi-year professional programs, they’ve often borrowed the maximum amount allowed through DOE programs.

- Skilled trades and specialty training: Federal financial aid programs aren’t always available for shorter-term training programs.

- Residencies, fellowships & internships: Living, travel, or relocation expenses for additional/extended research and learning opportunities might not be covered by traditional financial aid.

- Independent schools: Some mission-driven schools, such as faith-based colleges, choose not to participate in government-funded student assistance programs.

Now that you have an idea of the many degree-seekers you can help, let’s look at some of the student loan management software tools you can use to support them, specifically, Reports.

Reporting Throughout the Student Loan Lifecycle

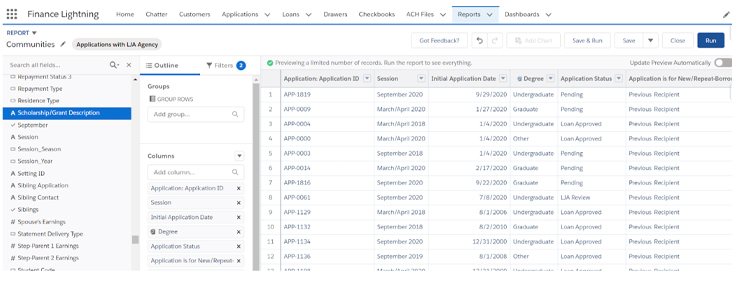

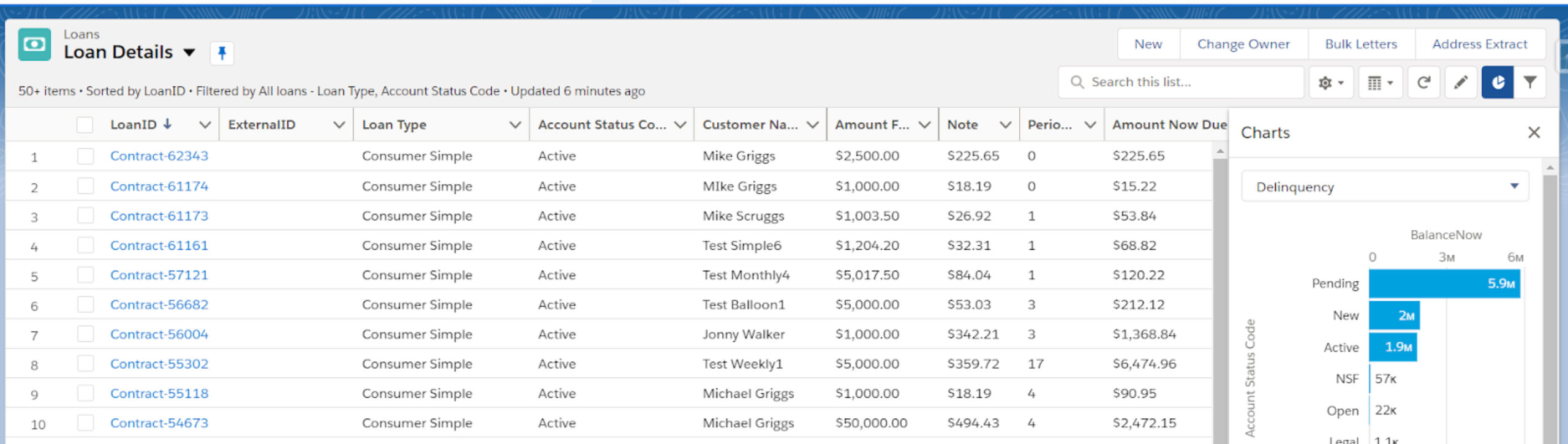

Your loan management system should have robust report generation capabilities, including those essential to your day-to-day business operations. When it comes to more niche lending products, such as student loans, customized reports are crucial.

IvyTek Finance’s loan servicing solutions are end to end, from origination throughout the lifetime of the loan — and your student-borrowers will experience plenty of academic milestones during that time. Many of these scholastic events, like graduation, coincide with key points in the loan terms. With custom reporting, you can drill down to see where each borrower is in their educational journey.

Using Custom Fields to Generate Relevant Reports

Gaining this insight starts with gathering specific data—and taking advantage of hundreds of custom field options available to you in IvyTek Finance’s complete lending management system. Some information you could collect from student borrowers include:

- Degree level

- Degree program

- School name

- School type

- School start date

- Expected graduation date

- Enrollment status

- Student resident status (on campus, etc.)

- School certification status (proof of enrollment)

And, of course, these custom student loan-related fields go hand in hand with the standard loan tracking information you’d use in any private lending solution.

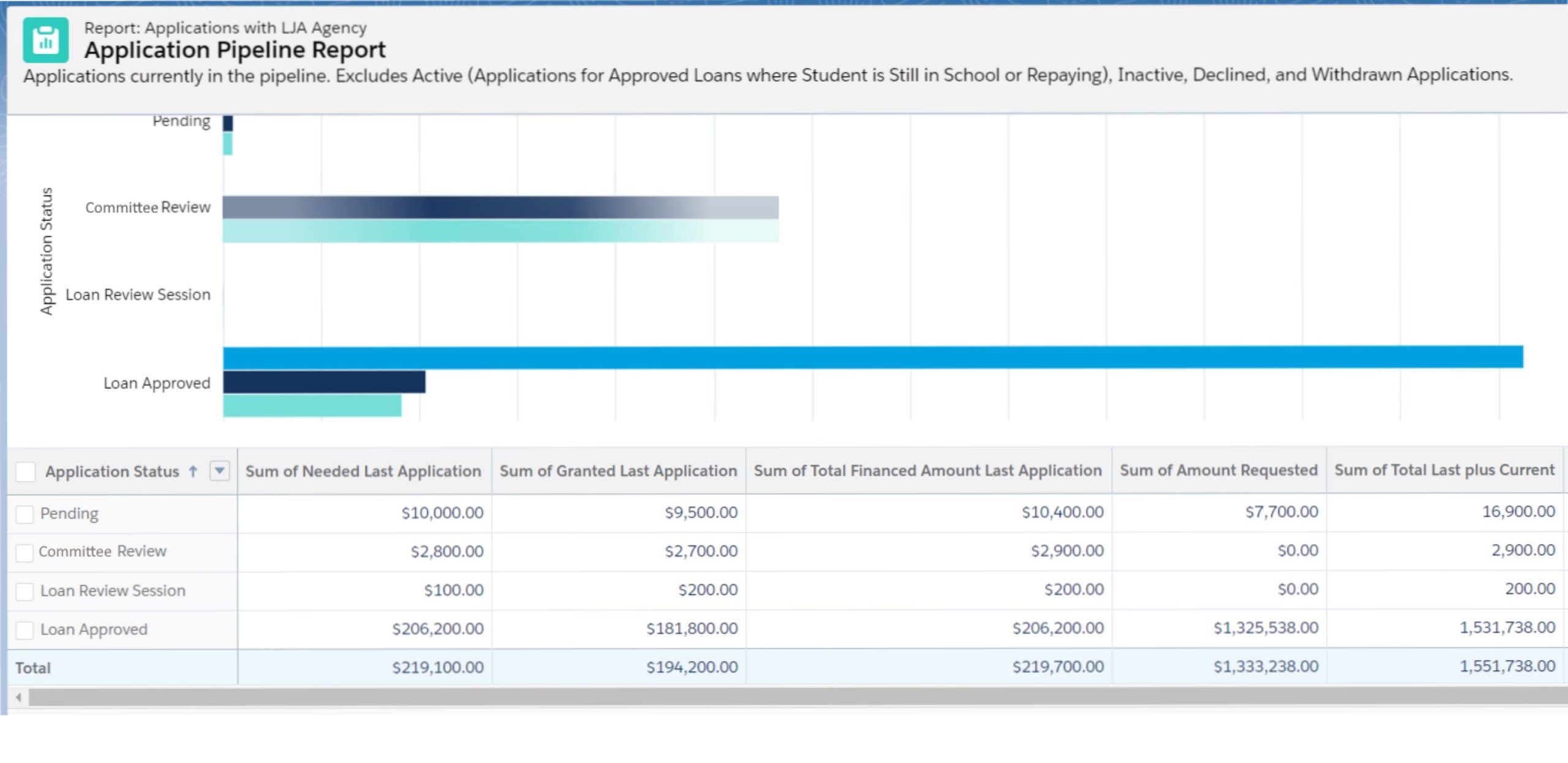

Building Actionable and Informative Student Lending Reports

The essence of running a useful report is asking a specific question. In the student lending space, some industry-specific questions we might consider include:

Who is still in school? Who is graduating soon?

Fair interest rates and flexible payment terms are hallmarks of student loans, so you may offer your borrowers the option to begin repayment after graduation. This report keeps you apprised of who is going into repayment soon, which aids in forecasting.

Who is in forbearance? Who is in deferment?

Federal student loan programs offer forbearance options for borrowers experiencing hardship, and many private lenders offer similar options in extenuating circumstances. Existing loans from a past educational experience can also typically be deferred (payments put on hold) if a student returns to school to continue a program or earn an additional degree.

Who is behind? Who is at risk?

You could drill down payment history or risk reports using higher education industry benchmarks, such as graduation or job placement rate of a specific area of study, to identify borrowers who might benefit from proactive outreach.

These are just a few examples of how custom reporting can help you service and manage student loans successfully.

Other Benefits of Custom Reports in Student Loan Management Software

A one-stop, cloud-based loan servicing system like IvyTek Finance brings together the many moving parts of the lending process. With one single source of truth, your staff members will have access to accurate, updated information from wherever they are, whether in the office, working from home, or on the road. (And with a range of permission levels and views, they’ll only see what they need!)

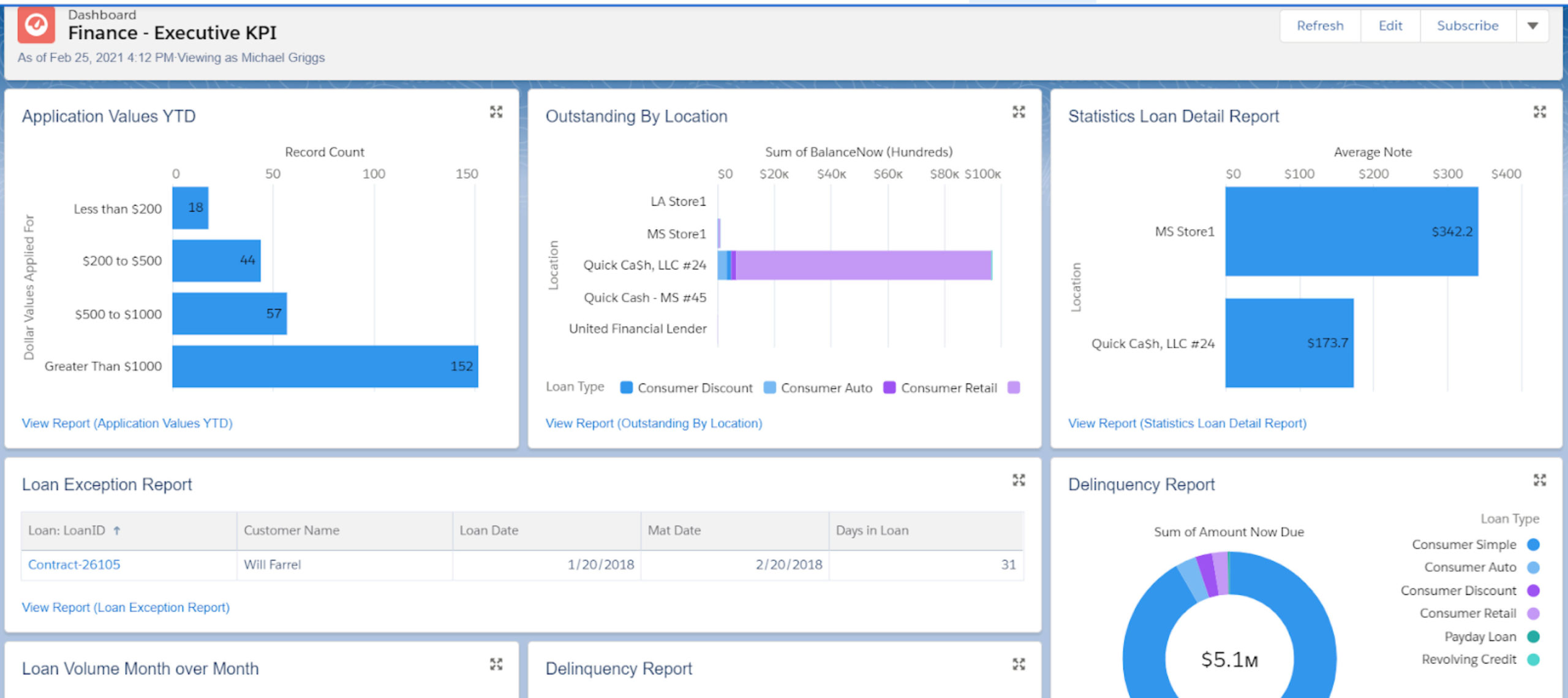

Keep Your Staff Informed with Powerful, Visual Dashboards

Good internal communication is key to positive morale. Give your student lending services team a high-level overview of the relevant business data by creating custom dashboard reports. At a glance, employees will get relevant information they need for their workday.

Create, Automate and Communicate: Workflows, Tasks and More

You’re able to build reports on the fly, of course. But you’ll also have the capability to create and schedule regular reports based on your business needs, which can be automatically shared with employees based on their roles and responsibilities.

Measure Your Social Impact: Use Report Data to Tell a Story

For many student loan lenders, providing people a means to pursue higher education is part of a larger mission to positively impact the communities they serve. By maintaining contact with individual borrowers after they complete their educational goals, you can gain valuable data that will help measure — and share — your collective impact to improve social mobility.

Student Loan Management Solutions for Retention & Engagement

If an educational institution is also the lender (or works closely with a loan servicing partner), custom reports can be integral to your student retention strategy.

Financial hardship can often impact someone’s academic performance, and it is one of the top reasons students leave school. Colleges and universities are notoriously siloed, meaning academic advising and financial aid offices, metaphorically, don’t talk to each other. However, it’s getting better: Many schools have launched collaborative, cross-department efforts to proactively identify at-risk students so they can provide the appropriate outreach at the appropriate time.

Higher education institutions, private lenders, and the borrowers themselves share a goal: for students to graduate and become their definition of success. As a lender, for you, part of that success means student loan borrowers fulfilling their commitment to you.

***

Standard and custom reports alike identify engagement opportunities that build relationships with borrowers. They help your finance, accounting, customer service, marketing, and other teams work smarter and make better decisions. And they constantly give you a glimpse into the health of your company.

Robust reporting features are among the many valuable benefits of IvyTek Finance’s student lending management software and its entire suite of loan servicing solutions.

We’d love to show you around our powerful system: Schedule a 10-minute demo today.

About Us

IvyTek, Inc. is a family-owned and operated company that produces custom software. The Griggs family has been in the software development business for over 25 years, spanning three generations.