SMS/Text Messaging in Loan Management

With its high open, read, and response rates, text messaging is proving to be one of the most reliable — and highest ROI — marketing channels in industries of all kinds, including financial services.

Sometimes referred to by its more technical term, SMS — short messaging service — is by no means a new technology. What is new, however, is its growing acceptance as a professional communication method. We talked to Rob Blatchley, Chief Revenue Officer of the mobile communication platform Mogli, about the benefits of text messaging in the financial services sector.

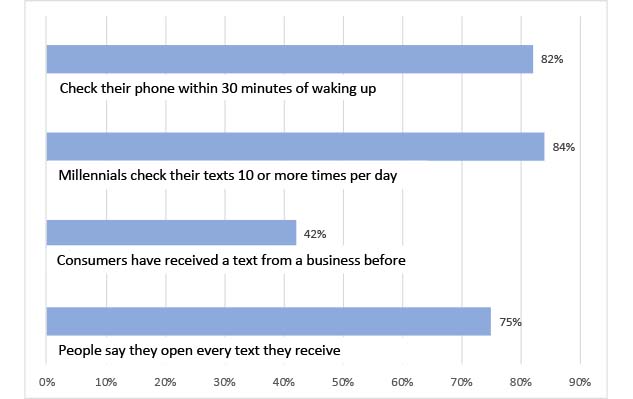

SMS Stats: Texting by the Numbers

Before we dive into the benefits and use cases for using SMS in your marketing and customer service efforts, let’s first look at just how ubiquitous texting is in our everyday lives. According to G2:

- 75% of people check their phone within 30 minutes of waking up

- the average customer spends four hours per day checking their phone

- consumers over 60 check their phones three or four times per hour

- 42% of millennials check their texts 10 or more times per day

- 84% of consumers have received a text from a business before

- 82% of people say they open every text they receive

These usage statistics make it clear why SMS marketing is so effective. For better or worse, people of all ages and backgrounds seemingly always have a device in hand.

Additional marketing-specific stats, also from G2, illustrate that potential or current customers are open to the idea of being reached by text. Perhaps most notable, and why Blatchley believes so deeply in SMS, is this: open rates can be as high as 98%.

Other SMS stats to consider as you think about adding texting to your marketing mix:

- SMS click-through rates are 10-15% higher than email marketing campaigns

- Consumers are 4.5x more likely to reply to an SMS marketing message than a marketing email

- 60% of consumers read a marketing text within five minutes of receiving it

- Marketers using three or more channels in their campaigns see a purchase and engagement rate 250% higher than marketing using a single channel

We’ll revisit some of these stats as we get into some use cases and scenarios for texting in the loan management industry.

Texting Tools of the Trade: Platforms & Services

Before we get into how texting can grow your lending management business, we’ll first take a look at some of the tools and techniques available in the SMS realm. Texting platforms like our partner, Mogli, part of the Salesforce AppExchange, offer a range of tools and resources such as:

- Bulk texts

- Real-time, 1:1 conversations

- MMS (multimedia messaging)

- Voice texts

- Chatbots

- Surveys

- What’sApp (for international customers)

- Automated workflows

- Analytics

- Text to pay

If your company is already automating some or all of its marketing efforts, it makes sense to choose a platform that integrates with your existing customer relationship management system and internal workflows. Salesforce is one of the most robust CRMs available, and that’s one of the biggest advantages of choosing IvyTek Finance as your loan management software: it’s built on Salesforce. And so is Mogli.

“The beauty of Mogli is, as a native Salesforce app, you can use the great information you already have,” explains Blatchley. (And any new information you collect is then automatically updated in your existing system.)

That seamless integration is incredibly powerful. But no matter what CRM or SMS software service you choose, adding texting to your marketing mix is incredibly wise.

Use Cases for Texting in Lending Services & Loan Management

In our conversation with Blatchley, we talked about SMS myths related to marketing and customer relationship management. One of the most common things he hears is that people assume texting has similar response rates as email. Blatchely says that some people also assume SMS is cost-prohibitive. When you consider the incredibly high response rates along with how a texting strategy can integrate with overall company initiatives — from marketing to customer service — the value of the investment becomes clearer.

SMS can be an effective marketing method, but it is also an incredibly valuable tool throughout the customer lifecycle. For instance, Blatchley explains, “As the loan application is processed, SMS can be used through all the different stages.”

From brand awareness to customer retention, let’s explore how lenders and financial services companies can use text messaging as part of their overall customer engagement strategy.

Texting for Lead Generation & Qualification

Like email, marketing to someone via text message requires an opt-on. One technique for generating a lead while simultaneously getting permission is to encourage a potential customer to text a keyword to your number.

You might have seen this inbound marketing practice before, such as in a commercial for a new medication, a billboard for a college, or on a print mailing for a political candidate. It’s a quick, easy way for someone to express interest in a product or service. In the case of a lender, perhaps someone would be asked to text LOAN or LOWERRATE.

“This is one of my favorite use cases,” Blatchley says of lead generation and qualification by SMS. He explains that once someone sends the text, the SMS marketing platform can determine if that customer is already in the system.

“We can ask, ‘do we know who this person is?’ and then fill in some additional information. If not, we can send a follow-up question by text.” From there, Blatchely explains you can create (or update) a lead, create an opportunity, assign them to a business development rep, and/or add them to a specific campaign.

Blatchley is clear to point out that rules surrounding SMS marketing continue to evolve; today, you must get additional permission to continue sending messages to someone after their initial “text a keyword” request.

Texting for Lead Generation & Nurturing

Once you’ve acquired a potential client — someone who doesn’t immediately fill out a loan application — you’ll probably add them to a nurturing campaign. Email has long been associated with lead nurturing, but as noted in the statistics shared earlier in this post, multichannel marketing is far more effective.

“Email has its place, of course,” Blatchely explains, “But texting can complement email so that it’s not the sole channel. SMS works well alongside email.”

You could add a text element to an existing drip campaign or even initiate individualized outreach. Some calls to action for nurturing by text could include:

- Complete a request for information form

- Start a loan application

- Download a guide our resource

- Schedule an appointment

“When things have stalled, when email is not working, send a text,” encourages Blatchley on keeping potential customers engaged.

Texting for Closing the Sale: From Applicant to Borrower

When it comes to lending, texting is also valuable further along in the sales funnel. You can use your SMS platform’s internal tools to send status updates, friendly nudges to upload required documents, or even details about a timely promotion.

“Loan officers have a great opportunity to have sales conversations through text,”

Blatchley says. For example, at the approval stage, one-on-one, personalized communication could go a long way in building trust.

And, when an opportunity is likely to close, but there’s a lapse in communication, remember: Research shows that consumers are 4.5 x more likely to reply to a text than an email.

“When you get ghosted on email, try texting to get a response,” says Blatchley.

Texting for Customer Service & Retention in Loan Servicing

Texting your borrowers is win-win. You want your clients to be successful in making their payments on time, and they want to avoid late fees. When your customer opts in, you can send them account alerts, payment reminders, transaction notifications, and other messages.

Depending on what your SMS software provides, you could also provide automated customer service. Mogli, for instance, has chabot functionality that can connect your borrowers to articles in your knowledge base or create a ticket for live support.

Finally, when it comes to texting and customer service and retention, you can also send brief surveys to measure borrower satisfaction; this could be about the overall experience with your company or specific to an interaction with one of your employees.

“Surveys are huge,” Blatchley says about Mogli’s growing suite of services and tools. “We see them used so often with nonprofits.”

Compliance Considerations

One thing to keep in mind, especially in financial services, is compliance. Just as there are rules for marketing by email, texting comes with its own set of regulations. It’s important to work with a trusted platform or service provider that understands the ever-evolving industry best practices. Still, because each industry also has unique policies and regulatory measures, Blatchely strongly suggests running any mobile communication strategy by your company’s legal counsel.

Getting Started: Easing into SMS

As you can see, there are many ways you can use texting to market to and engage with your potential and current borrowers. However, you can ease your way into the SMS landscape, perhaps with one use-case — and then build your strategy from there.

When choosing an SMS solution, it’s important to consider if and how a platform integrates with your existing CRM; that seamless connection keeps your data accurate and ensures smoother workflows.

It also helps if the platform offers support and training. In fact, another misconception Blatchley hears often is that it’s difficult, technologically and logistically, to set up a texting solution. It doesn’t have to be. Companies like Mogli provide a tremendous amount of support as they onboard new clients. IvyTek Finance and Mogli, in fact, work hand-in-hand to help our shared clients maximize their texting strategy.

“You don’t need someone technical on your team,” Blatchley explains. “Our client success managers can help you figure out what you can and can’t do.”

IvyTek Finance recognizes the value text messaging brings our lending management clients. But companies of all sizes, across sectors and around the world, are seeing incredible results with SMS. Blatchely reflects back on the 98% open rate. When it comes to sending texts, “they are all but guaranteed to be read.”

He continues: “SMS, as a whole, has really transformed businesses.”

To learn more about IvyTek Finance and Mogli and how we integrate with other Salesforce-driven technologies like the SMS platform Mogli, schedule a free demo today.

About Us

IvyTek, Inc. is a family-owned and operated company that produces custom software. The Griggs family has been in the software development business for over 25 years, spanning three generations.